b&o tax seattle

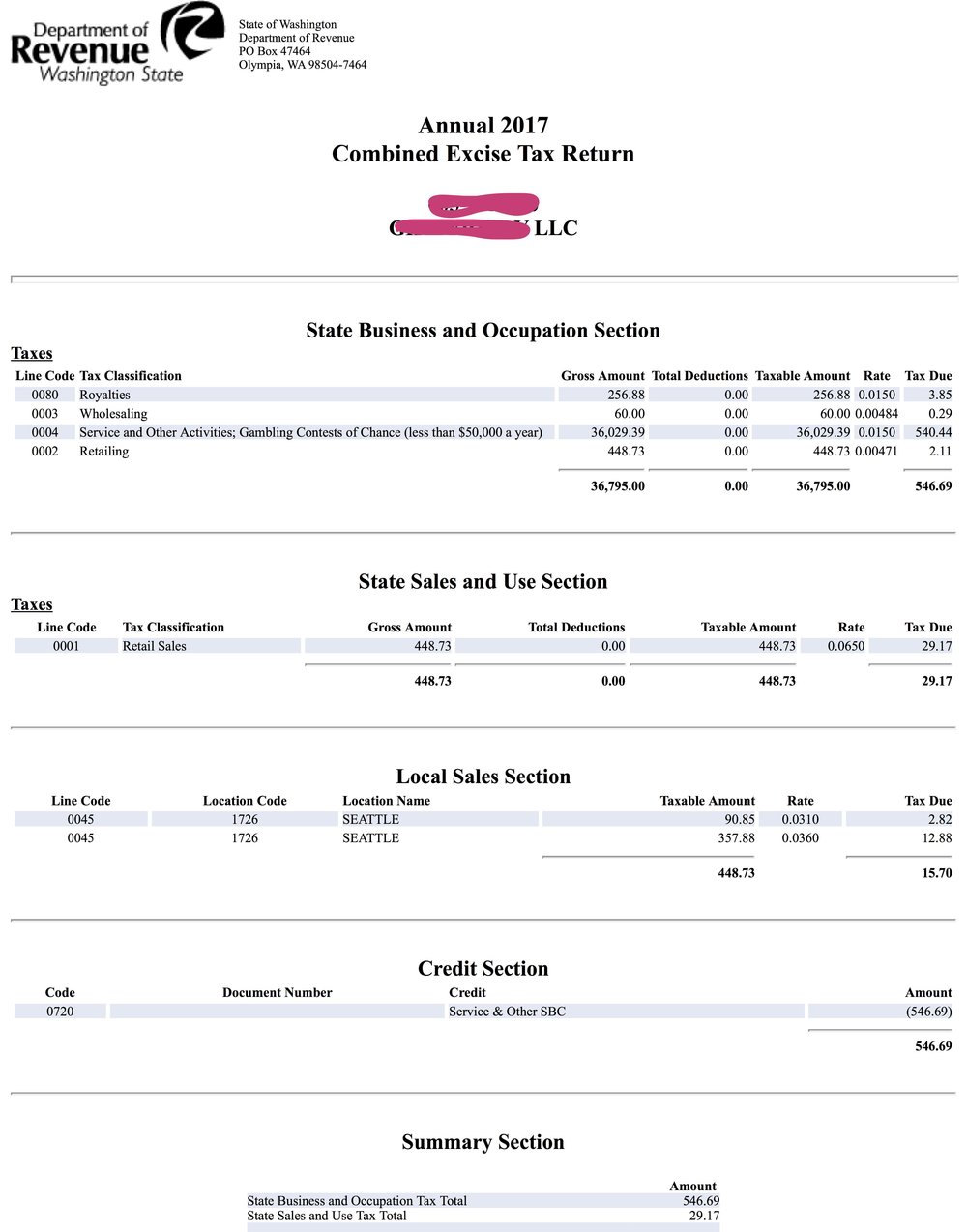

Manufacturing Processing for Hire Extracting Printing Publishing Wholesaling and. Multiply the taxable amount by the rate shown and enter the amount under Tax Due.

Business License Tax Seattle Business And Occupation Tax B O Tax Community Business Services Inc Tax And Accounting

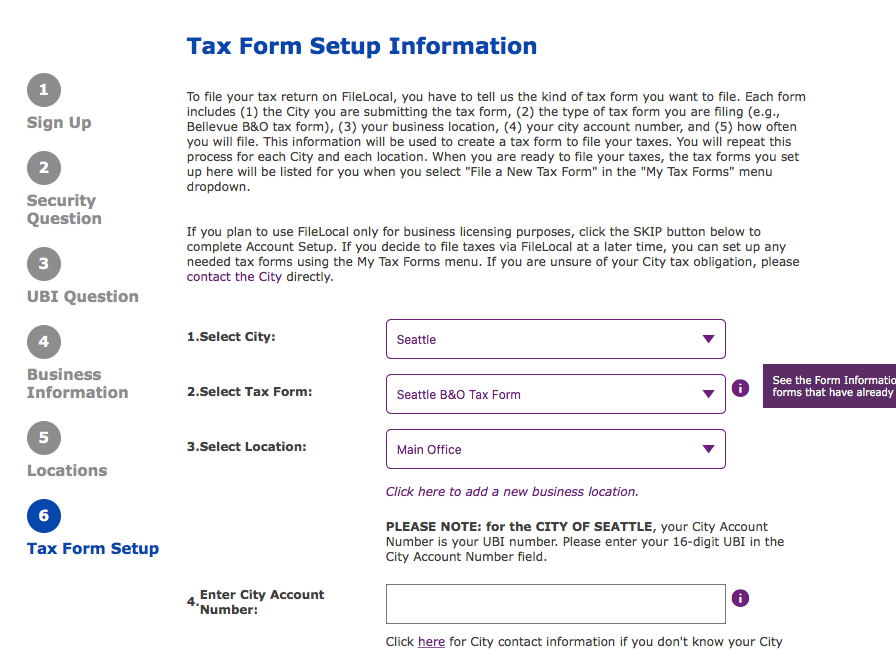

FileLocal offers businesses a one stop place to meet their license and tax filing needs.

. It applies to the gross income of the business. If you do business in Seattle you must. Service other activities015.

600 4th Ave 3rd Floor Seattle WA 98104 Mailing Address. 24 2020 the Washington Court of Appeals determined that the city of Seattle used an unlawful method to calculate the citys Business and Occupation BO tax liability of a broker-dealer taxpayer. If youre a first-time user create a business account below.

Business occupation tax classifications. PO Box 94728 Seattle WA 98124-4728 Phone. The Seattle business license tax is applied to the gross revenue that businesses earn.

This is the same portal many taxpayers currently use to file and pay a variety of other Seattle business taxes including BO Commercial Parking Admissions etc. If you need to file a 2021 annual tax return and have revenue that is below the 100000 threshold you can use this tax form. The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts.

Specialized BO tax classifications. Contact the city directly for. The square footage BO tax applies to businesses that maintain a business location within Seattle and conduct out-of-city business activities.

If a city is not listed they have not reported to AWC that they have a local BO tax. For tax assistance or to request this document in an alternate format please call 1-800-647-7706. Washingtons BO tax is calculated on the gross income from activities.

The square footage BO tax is based on rentable square feet. Entities engaging in business inside the Seattle city limits are required to pay a business and occupation BO tax. Our public counters on the 4th floor of the Seattle Municipal Tower 700 Fifth Ave are now open by appointment only Tuesdays and Wednesdays 830 am-4 pm.

Need to get a city business license or pay local business taxes like BO. Washington unlike many other states does not have an income tax. Tax rates are provided for cities with general local BO taxes as of the date listed.

No deduction is allowed for labor materials taxes or other costs of doing business. Sign in if you already have an account. It is sometimes called the Seattle business and occupation tax BO tax or gross receipts tax.

For Tacoma based businesses that paid less than 10000 in BO tax in 2019 the. Returns are not deemed filed until both tax filing and. 32 rows Business occupation tax classifications Print.

For products manufactured and sold in Washington a business owner is subject to both the Manufacturing BO Tax and the Wholesaling or Retailing BO Tax. If your business is a professional services firm like a law or accounting firm and you are filing a local tax return for 2019 the tax rate you will pay is 000427 or 427. The appropriate BO tax classification depends on the nature of the business activity.

FileLocal is the online tax filing portal for the City of Seattle. The tax amount is based on the value of the manufactured products or by-products. You may also reach us via email recommended at taxseattlegov or by phone at 206 684-8484 from 8 am.

To 5 pm Monday-Friday excluding City holidays. Simple fast and time-saving. Manual forms can be completed and mailed to the address provided on the back of the form.

The BO tax is calculated based on gross business receipts less allowable deductions and businesses fall into one of two rate categories. License and tax administration 206 684-8484 taxseattlegov. If your business is printing and you are filing a local tax return for 2018 the tax rate you will pay is 000222 or 222.

Tax Classifications Rates. Seattle 206 684-8484 000222 v 000222 v 000427 v 000222 v 100000 Shelton 360 426-4491 0001 0001 0001 0001 5000 20000. 1 Specifically Seattle unfairly apportioned the tax by excluding amounts paid to independent contractors from the taxpayers payroll factor.

Extracting Extracting for Hire00484. It is sometimes called the Seattle business and occupation tax BO tax or gross receipts tax. This means if your BO taxable revenue for 2019 was less than 5 million you may file your 1st and 2nd quarter revenue on your 3rd quarter tax return in October.

However you may be entitled to the. Have a Seattle business license see the due dates for that here file a business license tax return. This means there are no deductions from the BO tax for labor materials taxes or other costs of doing.

Depending on your situation filing your Seattle taxes may be relatively simple or fairly complex. BO 11-7-17 Litter Tax Line 11 1. It is measured on the value of products gross proceeds of sale or gross income of the business.

Teletype TTY users may use the Washington Relay service by calling 711. Open Monday through Friday 8 am. Box 34214 Seattle WA 98124-4214.

The state BO tax is a gross receipts tax. Enter the taxable sales for litter tax under Taxable Amount. The City of Seattle is deferring BO tax filings for first and second quarter for small businesses.

The BO tax is a gross receipts tax assessed against an entity for conducting business in Washington. The current tax rates are 039 per square foot per quarter for business floor space and 013 per square foot per quarter for other floor space.

Excise Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

City Of Seattle Business Licenses

Filelocal Annual Report To Seattle Seattle Business Apothecary Resource Center For Self Employed Women

B O Tax Annual Report To Wa Dor Seattle Business Apothecary Resource Center For Self Employed Women

Wa Business Occupation Tax Return Tumwater Fill Out Tax Template Online Us Legal Forms

Tax Legal Basics Seattle Business Apothecary Resource Center For Self Employed Women

Why Our B O Tax Is Unfair R Seattlewa

The Infamous B O Tax Seattle Business Magazine

City Of Seattle B O Tax Deferment Information Essential Southeast Seatte

Explained Business And Occupation Taxes At The Local Level The Doty Group Cpas Tax Assurance Accounting Litigation And Valuation

B O Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

Business License Tax Seattle Business And Occupation Tax B O Tax Community Business Services Inc Tax And Accounting

Tax Legal Basics Seattle Business Apothecary Resource Center For Self Employed Women

B Amp O Tax Return City Of Bellevue

Business License Fees And B O Taxes Going Up

City Of Seattle License Fill Online Printable Fillable Blank Pdffiller

State Supreme Court Upholds B O Tax On Large Banks In Washington Mynorthwest Com