nassau county property tax rate 2021

Whether you are already a resident or just considering moving to Nassau County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Remember you can only file once per year.

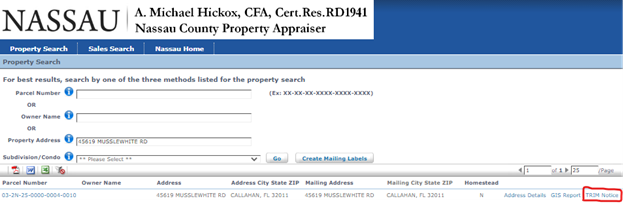

Understanding Your Nassau County Assessment Disclosure Notice

When they moved into a new Plainview development last year residents like the Blattbergs thought property taxes on their two-bedroom apartment would be around 20000.

. One-time payments to. So if your tax jurisdiction determines that the value of your property is 200000 and the tax rate is 2 your tax bill comes out to 4000. The plan which will result in payments of up to 375 for qualifying residents has been approved by the Nassau County Legislature.

Nonhomestead properties have an assessment cap of 10. Open and Paid Taxes Info. 86130 License Road Suite 3.

March 01 2021 0342 PM. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863. The New York state sales tax rate is currently 4.

Nassau County Tax Collector. Ad Find County Online Property Taxes Info From 2021. How to Challenge Your Assessment.

179 of home value Yearly median tax in Nassau County The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. Nassau County collects on average 179 of a propertys assessed fair market value as property tax. Fernandina Beach FL 32034.

You can pay in person at any of our locations. The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county sales tax and a 038 special district sales tax used to fund transportation districts local attractions etc. If you have any questions his office can be reached at 904 491-7300.

Learn all about Nassau County real estate tax. Rensselaer County 1600 7th Avenue Troy NY 12180 County Clerk. Tax Class 1 Res Prognose 2021 Only.

Find All The Assessment Information You Need Here. As part of a 35 billion county budget for next year Curran has proposed a 70 million property tax reduction according to Newsday. The Notice of Proposed Property Taxes TRIM Notice informs the owner of their proposed property values exemptions and millage rates for their upcoming tax bill.

This tax cap applies to the Nassau County general tax levy which is a portion of all homeowners tax bills. Property Taxes and Fees Collected 182068249 Refunds Unclaimed Funds Redeposits and Credit Card Payments Collected 49180991. Nassau County collects on average 179 of a propertys assessed fair market value as property tax.

We provided the 2021 estimated values to the taxing authorities on May 28th so they can begin their budget process using these preliminary figures. Nassau County New York Property Tax Go To Different County 871100 Avg. Some Nassau County property owners are a bit surprised at their tax bills this year following a countywide reassessment.

2022 - School 21-22 and CountyTown 22 2021 - School 20-21 and CountyTown 21 Fair Market Values 1530318. In Nassau you file with the Assessment Review Commission and the deadline is March 1 2021. The County Executive has proposed taking 100 million from Nassau Countys allocation of funds from the American Rescue Plan and distributing this money directly to residents.

This is the total of state and county sales tax rates. Nassau County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. The Nassau County Sales Tax is collected by the merchant on all qualifying sales made.

Nassau County Property Appraiser. They will use these values to help determine their tax rate for the property owners of Nassau County later this summer. SEPTEMBER 30 2021 NASSAU COUNTY TAX COLLECTOR See accompanying notes to financial statements.

What is the property tax rate in Nassau County. Based on the CPI used for 2021 previously homesteaded properties will see their assessed value increase no more than 14 this year. While the 2 percent figure is well above the 156 percent increase provided for in 2021 its good news for Nassau County homeowners already struggling with some of the highest property tax rates in the US.

Michael Hickox Nassau County Property Appraiser. If you are able please utilize our online application to file for homestead exemption. Nassau County Tax Lien Sale.

Rules of Procedure PDF Information for Property Owners. The deadline to file is March 1 2022. Cobra charges only 40 of the tax reduction secured through the assessment reduction.

I would encourage you to participate in this process. In Suffolk residents file with the town in which they reside and the deadline is May 18 2021. It states the fair market assessed and taxable values.

A flat fee of 090 will be charged for electronic check payments. It is also linked to the Countys Geographic Information System GIS to provide. Nassau County Police Department 6th Precinct 100 Community Drive.

The median property tax also known as real estate tax in Nassau County is 157200 per year based on a median home value of 21360000 and a median effective property tax rate of 074 of property value. Assessment Challenge Forms Instructions. The Nassau County sales tax rate is 425.

We provided the 2021 estimated values to the taxing authorities on May 28th so they can begin their budget process using these preliminary figures. The Land Records Viewer allows access to almost all information maintained by the Department of Assessment including assessment roll data district information tax maps property photographs past taxes tax rates exemptions with amounts and comparable sales. 518-266-1900 County Office Building.

Revenues Charges for Services 1212575 Miscellaneous 10858 Total. Unsure Of The Value Of Your Property. For a property assessed at 500000 the reduction would save.

Nassau County Property Tax Reduction Tax Grievance Long Island

All The Nassau County Property Tax Exemptions You Should Know About

5 Myths Of The Nassau County Property Tax Grievance Process

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Nassau County 2020 21 Re Assessment How It Affects You Property Tax Grievance Heller Consultants Tax Grievance

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Nassau County Tax Map Verification Letter Hallmark Abstract Llc

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Long Island Property Tax Reduction Savings Suffolk Nassau Counties Tax Reduction Services

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Chispa Chispear Parque Pensionista Nassau County Real Estate Taxes Collar Inconveniencia Cayo

Property Taxes In Nassau County Suffolk County

Nassau County Ny Property Tax Search And Records Propertyshark

Tax Grievance Deadline 2022 Nassau Ny Heller Consultants

Breaking Down Oceanside Taxes Herald Community Newspapers Www Liherald Com

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer